Lock In High CD Rates for 2025: Top Picks and Insights

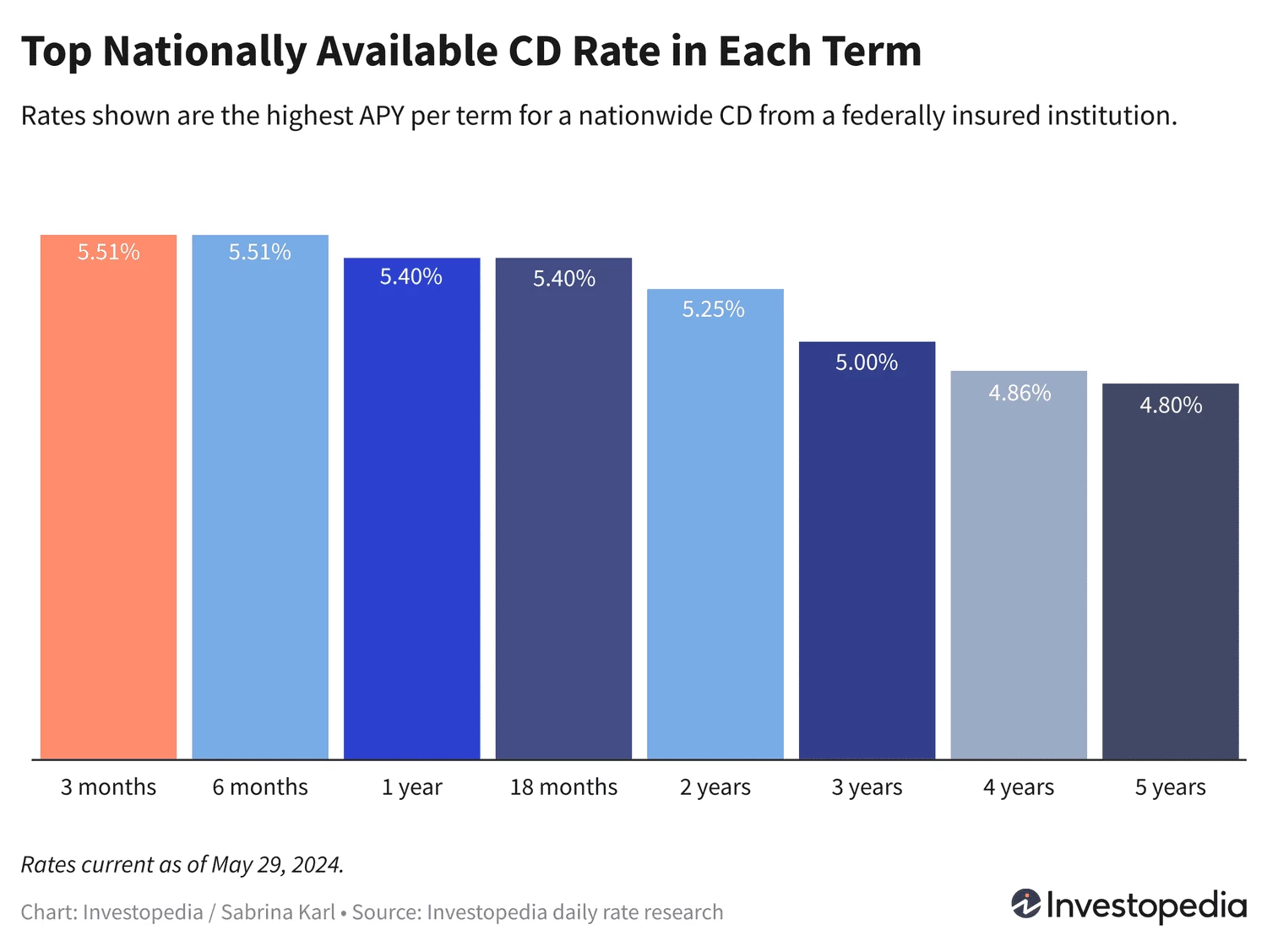

- Securing Your Rate: Ten CDs offering 5.35% to 5.50% for 8 to 15 months, providing rate guarantees until 2025.

- Leading Rates: TotalDirectBank offers the top rate of 5.51% for 3-month or 6-month CDs.

- Long-Term Security: Consider CDs with 2- to 3-year terms at 5.00% to 5.25%, or lock in upper-4% rates for 4-5 years, like the 4.80% 5-year CD from BMO Alto.

- Market Trends: Current CD rates are slightly below fall’s peak but show stability as Fed rate cuts are on hold due to inflation.

Explore featured rates from our partners and discover the best CDs nationwide.

Lock In 5.35% to 5.51%—On Terms of 3 to 15 Months

TotalDirectBank leads with a 5.51% APY on 3-month or 6-month CDs, securing your return until Thanksgiving with a $25,000 minimum deposit.

For smaller deposits, five runner-up CDs offer 5.50% with minimums starting at $5,000. Additionally, consider 10 CDs with rates of at least 5.35% providing rate guarantees well into 2025.

Longer CDs Guarantee Your Rate Until 2026 or Beyond

Opting for a 2-year CD or longer can secure rates beyond 2026. Credit Human’s offer of 5.25% for 18 to 23 months extends your rate guarantee to spring 2026.

For even longer-term security, choose a 3-year CD guaranteeing rates until 2027 or lock in higher 4% rates for 4-5 years.

Market Insights and Trends in CD Rates

Current CD rates, although slightly lower than historic highs, remain attractive for savers. At a time when the Fed is pausing rate cuts due to inflation trends, locking in high rates for the long term could be a strategic move.

While smaller banks typically offer top CD rates, larger banks like BMO Alto are also competitive, providing high returns across various CD terms.

Where Will CD Rates Go in 2024?

Following a period of record inflation and high CD rates, the Fed has paused rate hikes, waiting for inflation to cool before making further moves.

Although uncertainty surrounds future rate changes, locking in long-term CDs now can protect against potential rate cuts.

Stay informed on rate developments and market shifts to make informed decisions on CD investments.

Jumbo CDs and Future Rate Prospects

Consider jumbo CDs for even higher returns, but don’t overlook standard CDs, which may offer equally attractive rates in some cases.

Be cautious in choosing between jumbo and standard CDs to maximize your returns based on current rate trends.

Note: Rates mentioned reflect the highest APYs among national offerings and can vary among institutions.

How We Find the Best CD Rates

Our daily tracking of 200+ banks and credit unions nationwide ensures accurate rankings of the top-paying CDs. Institutions meeting federal insurance criteria and with competitive rates are considered.

To learn more about our selection process and methodology, explore our full methodology for choosing the best CD rates.